Nonprofits and Fintechs Improving Benefits Access: Our 2022 Exchange Grantees

The Financial Solutions Lab has awarded grants to three partnerships that make up our 2022 Exchange cohort. The nonprofit and fintech organizations in the cohort will work to promote financial health by improving access to benefits and measuring the impact of their projects on the consumers they serve.

How Digital Communities Can Drive Financial Decision-making and Customer Satisfaction

In collaboration with legal empowerment fintech Upsolve, we explore how incorporating a digital community into fintech tools can support user financial decision-making and improve customer satisfaction.

Navigating the True Costs of Auto Insurance for Low-income Americans

Financial Solutions Lab alums Propel and Sigo Seguros discussed providing affordable and accessible auto insurance to the Spanish-speaking market. Between higher purchase prices and the fluctuating cost of gas, auto ownership and maintenance is stretching the budgets of many households across the country. And that's before you consider the fact that a disproportionate number of drivers from immigrant and low-income communities are rated as "high risk" policyholders and pay above average insurance costs.

Building Consumer Savings with Fintech Innovations

Savings are a critical component of financial health, and new approaches can encourage consumer savings.

Financial Solutions Lab Announces 2022 Accelerator Cohort

The Financial Solutions Lab, an initiative launched and managed by the Financial Health Network in collaboration with founding partner JPMorgan Chase & Co. and with support from Prudential Financial, today announced that it has selected six organizations for its 2022 Accelerator program which is focused on financial benefits and tools.

Financial Solutions Lab selects six for 2022 cohort

The Financial Solutions Lab, an initiative launched and managed by the Financial Health Network in collaboration with founding partner JPMorgan Chase & Co. and with support from Prudential Financial, today announced that it has selected six organizations for its 2022 Accelerator program which is focused on financial benefits and tools.

Financial Solutions Lab Announces 2022 Accelerator Cohort Focused on Access and Removing Systemic Barriers to Financial Benefits & Tools for Underserved Consumers

Selected companies focus on streamlining low- to moderate-income, Black, and Latinx individuals’ navigation and use of benefits and tools in support of better financial health.

Improving Benefits Systems With Nonprofit-Fintech Partnerships: 2022 Exchange Challenge

The 2022 Exchange Challenge focuses on nonprofit-fintech partnerships that can advance financial health for people navigating benefits systems.

Better Together: Meeting the Needs of Consumers of Color Through Partnerships

Change Machine and NALCAB share some key takeaways for nonprofit practitioners and fintech providers who are committed to reducing the digital divide.

Meeting the Needs of Consumers of Color With Fintech

How can innovation better serve consumers of color? Join us to understand how fintech tools and trusted community institutions can support the financial health of consumers of color and young people.

Have fintechs cracked the financial inclusion code?

Financial Health Network President and CEO, Jennifer Tescher, joins on Bankshot podcast at the Money 20/20 conference in Las Vegas, Nevada.

The newest fintech bank account is for the formerly incarcerated

If you were to look at fintech apps at random, you’d quickly spot ones that help you collect your paycheck earlier, settle up IOUs and invest your money. If you spent a little more time digging, you might uncover banking apps designed for immigrants, Black Americans and the LGBTQ community. What you likely wouldn’t notice are products built for the formerly incarcerated. Until recently.

Fintech and vulnerability

Fintech is having an enormous impact on the financial affairs of some of the most vulnerable in society.

2021 Finovate Award Winners Unveiled

Today we’re busting out the virtual confetti to announce the winners of the 2021 Finovate Awards, recognizing excellence in fintech across 25 different categories. This is the third annual Finovate Awards competition, which aims to highlight strong work done by the companies who are driving fintech innovation forward and the individuals who are bringing new ideas to life.

The Case for Diversity in Innovation

Fintech plays an important role in helping to democratize access to finance, making it imperative that more fintech solutions target the underserved and those who are not financially healthy.

Startups for Good

Interview with Hannah Calhoon, vice president of Innovation at the Financial Health Network.

Fintech as a Solution for Employee Financial Health: Findings from Five Exploratory Studies

We partnered with five fintechs – Brightside, HoneyBee, Manifest, MedPut, and Onward to explore how they’re used and their impact on employees’ financial lives.

6 ‘jugaad’ principles that could rebuild the post-COVID-19 U.S. economy

The U.S. must look to places like India, Brazil, Africa, and China for a new approach to frugal and flexible innovation called jugaad—a Hindi word meaning “the gutsy art of improvising a solution in difficult conditions with limited resources.”

The Innovators 2021: Best Innovation Labs

The notable fintech hubs, labs, incubators, and accelerators examined by Global Finance this year have both turned to technology to function during Covid-19 and nurtured startups that help financial institutions operate in a socially distanced world.

Bank-Fintech Partnership Powers Financial Health

Join Rochelle Gorey, CEO and Co-Founder of SpringFour, and Ben Schack, Head of U.S. Digital Partnerships for BMO Financial Group, as they discuss their innovative financial health partnership. Learn how this award-winning social impact fintech and multinational bank teamed up to solve problems and deliver assistance for customers through the pandemic and beyond. Discover the impact of their efforts on their employees and brands, and consider tips for successful fintech-bank partnerships.

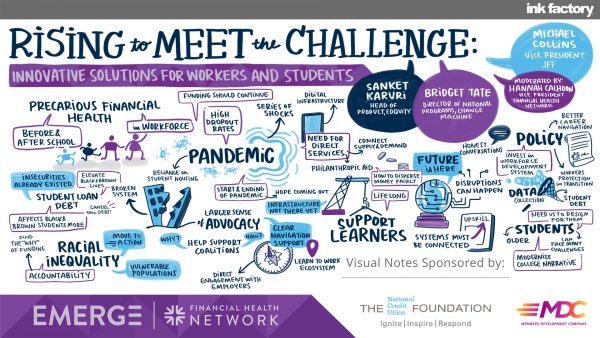

Rising to Meet The Challenge: Innovative Solutions for Workers and Students

Join us to learn how these innovators responded to the challenge, found ways to scale their offerings to meet the pressing financial health needs of the moment, and forged pathways to drive impact post-pandemic. We’ll also introduce attendees to the Financial Solutions Lab Accelerator’s new cohort of fintech startups, as we explore innovations that are helping consumers to build financial resilience and long-term stability.

The Evolving Role of Fintech in FinHealth

In this discussion, learn and share perspectives with financial health experts to start planning for the future of fintech and finhealth.

Earned Wage Access and Direct-to-Consumer Advances: Usage Insights and Policy Implications

Learn how consumers are using Earned Wage Access (EWA) and Direct-to-Consumer (D2C) Advance products to bridge gaps between earning and accessing income, gain data-driven insights to guide key decisions in a showcase of findings from our recent consumer usage research, and discuss the ongoing policy debate.

Exchange Fastpitch: Fostering Partnerships to Improve the FinHealth of Justice-Involved Individuals

Join us to learn more about the grant program and meet potential grant partners.

In Their Words: What Older Adults Struggling Financially Need

Despite the recent stimulus, increased vaccinations, and gathering momentum of reopenings across the country, millions are still struggling with their financial health. Ongoing economic uncertainty, job loss, and physical health concerns have caused many to shift financial priorities just to stay afloat. In the Financial Health Network’s latest…

Financial Wellness for Employees: Insights from Five Fintechs

Employer-channel fintechs play an increasingly crucial role in supporting employees’ financial health through products like low-cost loans, and financial coaching. The Financial Solutions Lab partnered with the Social Policy Institute at Washington University in St. Louis to examine the uptake, usage, and impact of five companies: Brightside, HoneyBee, Manifest, MedPut, and Onward.

Two Ways Policy and Technology Can Support Struggling Student Loan Borrowers

Student debt remains a critical topic for both borrowers and policymakers. Many borrowers now face the added financial challenge of unemployment as a result of the pandemic, and policymakers are urgently seeking ways to support these individuals. Now consider that Black and Latinx borrowers are disproportionately affected by the economic fallout from the pandemic, while […]

Designing Digital Financial Advisory Tools for Low-to-Moderate Income Older Adults

Most low-to-moderate income (LMI) older adults are financially challenged to reach retirement and maintain their quality of life as they age. This report showcases research insights and design features that financial service providers can leverage to better support the needs of this group as they approach retirement, produced in partnership with the Institute of Consumer Money Management.

Frugal Solutions

The Financial Solutions Lab is showing how traditional financial organizations can co-create with nonprofits and entrepreneurs to improve the financial health of all Americans. Read the article on Stanford Social Innovation Review >>

Fintech Innovation Leader Joins the Financial Health Network

Hannah brings a passion for financial health and knowledge of startups, nonprofits, financial services, and the fintech ecosystem at large. She will be responsible for the strategic direction of our Innovation practice, including the Financial Solutions Lab.

Welcome Hannah Calhoon to the Financial Solutions Lab

The Financial Health Network announced today that Hannah Calhoon has joined the team as Vice President, Innovation. In this role, she will be responsible for leading the Financial Solutions Lab, finding new ways to support our partners and innovators as they work to improve financial health for all. Learn more about Hannah’s past experience and […]

Fintech for All: Why Technology Accessibility Matters

Hear from an expert about the financial health challenges people with disabilities face and the opportunity to tailor fintech products and services to their needs.

The Fintech Effect: Consumer Impact and the Future of Finance

In this research, Plaid examines how consumers use fintech, how they feel about it, how it impacts their lives, and how all these sentiments vary across demographic groups.

Innovating to Fight Financial Instability: Our 2021 Accelerator Challenge

Over the past six years, the Financial Solutions Lab has run an annual fintech accelerator that has supported more than 40 companies with investments, resources, mentorship, and more to improve the financial health of people across the U.S. These companies have reached more than 5 million low- to moderate-income consumers – and over 10 million […]

Financial Solutions Lab Launches Seventh Accelerator Challenge to Support Fintech Solutions that Help Address Financial Instability

As part of $60 million, 10-year program, seventh annual Accelerator program now accepting applications from financial technology companies helping people improve financial resilience and build long-term financial growth in the wake of COVID-19 CHICAGO – Oct 27, 2020 – The Financial Solutions Lab, an initiative from the Financial Health Network in collaboration with JPMorgan Chase […]

Member Summit 2020: Nonprofit-Fintech Exchange Small Group

The Financial Solutions Lab 2020 Exchange fintechs and nonprofits share how they will leverage the unique strengths of both types of organizations to improve financial health for students and workers.

What Banks Need from Their Technology Stack to Support Consumer Financial Health

Explore insights into the relationship between bank tech stacks and consumer finances, including the evolution of digital banking and personal finance technology trends.

What Banks Need from Their Technology Stack to Support Consumer Financial Health

Now more than ever, older adults are at greater risk of medical emergencies. Yet many are also caretakers for family members – making them even more susceptible to medical financial shocks.

Building Cross-Sector Partnerships to Advance Financial Health Innovation

The challenges posed by deepening financial insecurity are having a profound and long-term impact on individuals and families, and solutions will require cross-sector collaboration and partnership. To support these solutions, the Financial Solutions Lab intentionally recruited members to its new Advisory Council who bring a vast range of experience and backgrounds, from organizational strategy to […]

Fintech Solutions: Innovations Advancing Worker and Student Financial Health

Learn how the Financial Solutions Lab 2020 Accelerator Cohort Companies are innovating to improve the financial lives of workers and students.

It’s the Organizational Siloes, Not Just the IT Stacks, that Are Sidelining Innovation

Since consumers clearly want the personal finance tools developed by fintechs and other innovators, why are banks and credit unions not offering them widely? The core challenge is to get fintech apps to talk with banks’ existing technology stacks and build a shared business case across the organization.

What Banks Need From Their Technology Stack to Support Consumer Financial Health

Explore the current landscape and opportunities to help financial institutions overcome these barriers to power effective finhealth tools.

2020 Branch Report

Provided by Branch, this research reveals how the coronavirus pandemic has affected the priorities and concerns for workers in sectors such as food service, retail, and healthcare.