Pulse Points: Financial Health Differences Among Entrepreneurs

More people across the U.S. are starting businesses than ever before. What is the relationship between entrepreneurship and financial health?

By Shira Hammerslough, Andrew Warren

-

Program:

-

Category:

-

Tags:

Understanding the Financial Realities of Entrepreneur and Non-Entrepreneur Households

Entrepreneurship is reshaping the American economy, offering new pathways for income generation, wealth-building, and economic mobility.1,2,3 While entrepreneur households tend to be more financially healthy than non-entrepreneur households overall, our research shows that the relationship between business ownership and household finances varies across the income spectrum.4,5

Using Financial Health Pulse® data, this report examines how household financial health differs between entrepreneurs and non-entrepreneurs – and how those differences shift by income level.6 Our findings indicate that the financial health advantage among entrepreneurs is substantial for low- and moderate-income (LMI) households but nearly nonexistent for middle- and upper-income (MUI) households. We also find that entrepreneur incomes are more complex and variable than non-entrepreneur incomes, and that LMI entrepreneurs are far less financially healthy than their MUI counterparts.

We also explore how demographic and financial characteristics intersect with entrepreneurship, providing a deeper understanding of the risks and rewards of business ownership.

What You’ll Learn

Read the full report to examine how entrepreneurship impacts household financial health.

Entrepreneur households are less likely to be Black, single, or retirement age.

LMI entrepreneurs are far less Financially Healthy than MUI entrepreneurs.

Both LMI and MUI entrepreneurs have complex finances, often with volatile incomes from multiple sources.

LMI non-entrepreneurs are struggling even more than LMI entrepreneurs.

Data Spotlight

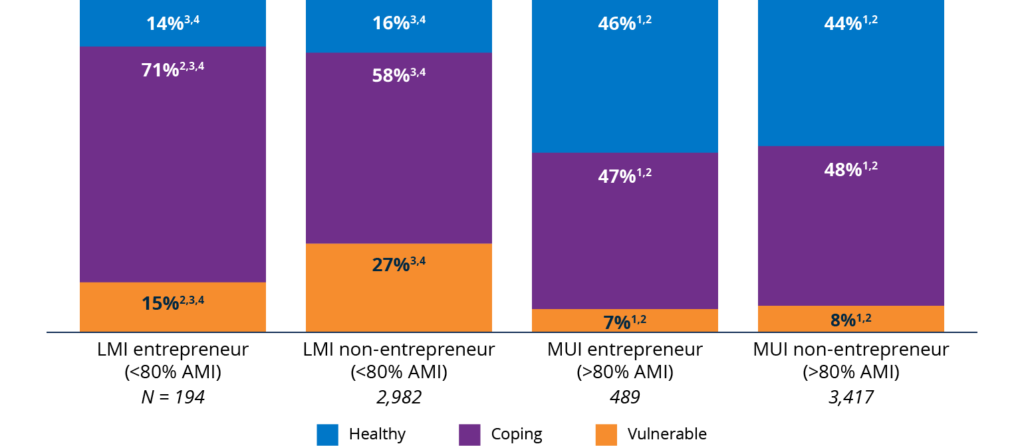

LMI entrepreneurs are financially healthier than LMI non-entrepreneurs, but still lag behind MUI households.

Percentage in each financial health tier, by entrepreneur status and income.

Note: Financial Health Pulse Survey 2024 data. Percentage points may not sum to 100% due to rounding. AMI is defined as the median household income for that household’s Metropolitan Statistical Area (MSA) or county. Percentage points may not sum to 100% due to rounding.

1 Statistically significant compared to LMI entrepreneur households at p<0.05.

2 Statistically significant compared to LMI non-entrepreneur households at p<0.05.

3 Statistically significant compared to MUI entrepreneur households at p<0.05.

4 Statistically significant compared to MUI non-entrepreneur households at p<0.05.

About Our Methodology

Data from this release come from the Financial Health Pulse survey. Now in its seventh year, Financial Health Pulse fields surveys using the probability-based Understanding America Study online panel administered by USC’s Dornsife Center for Economic and Social Research, allowing the findings to be generalized to the civilian, noninstitutionalized adult population of the United States. The 2024 Financial Health Pulse survey was fielded from April 16, 2024, through May 30, 2024, with 7,245 respondents and a cooperation rate of 65.67% (margin of error +/- 1.15%). For more background on our financial health measurement methodology, visit the FinHealth Score® Methodology page.

About the Financial Health Pulse® and Pulse Points

Since 2018, the Financial Health Network has conducted the Financial Health Pulse® research initiative. The Financial Health Pulse combines probability-based, longitudinal survey data with administrative data, with the goal of providing regular updates and actionable insights about the financial lives of Americans.

Pulse Points are short research reports released multiple times a year as part of the Financial Health Pulse research initiative. Pulse Points are designed to explore specific, timely topics related to financial health. To see more of our Financial Health Pulse research, including Pulse Points on student loans, natural disasters, and more, please visit our Pulse Research page.

- John Haltiwanger, “Entrepreneurship in the twenty-first century,” Small Business Economics, October 2021.

- Eric Van Nostrand, “Small Business and Entrepreneurship in the Post-COVID Expansion,” U.S. Department of the Treasury, September 2024.

- “Record-Shattering 20 Million Business Applications Filed Under Biden-Harris Administration,” U.S. Small Business Administration, November 2024.

- Justin Barnette and Andrew Glover, “Puzzlingly Divergent Trends in Household Wealth and Business Formation,” Federal Reserve Bank of Kansas City, May 2021.

- Chris Wheat, Chi Mac, & Nicholas Tremper, “Small business owner liquid wealth at firm startup and exit,” JPMorgan Chase, May 2022.

- Andrew Warren & Wanjira Chege, “Financial Health Pulse® 2024 U.S. Trends Report,” Financial Health Network, September 2024.

Written by

Pulse Points: Financial Health Differences Among Entrepreneurs

Explore the trends. Discover new insights. Build stronger strategies.