Earned Wage Access and Direct-to-Consumer Advance Usage Trends

One in five families has less than two weeks of liquid savings. For the many U.S. workers living paycheck to paycheck, financial distress can occur in the time between earning and accessing wages.

Financial Health and Criminal Justice: The Impacts of Involvement

Across each phase of involvement with the criminal justice system, individuals and their families often experience negative financial health outcomes.

3 Approaches to Using Administrative Data To Measure Financial Health

Choosing the best approach to implement will depend on a company’s proposed use case, available data types, and resources available for analysis.

Overdraft fees hit lower-income Americans hardest. Will other banks follow Ally in ending them?

Americans whose income took a hit from the coronavirus pandemic have paid more in overdraft fees than those who weren’t financially hurt by COVID-19.

BlackRock’s Emergency Savings Initiative: An Ecosystem Approach to Partnerships

BlackRock’s commitment to financial well-being has sparked a series of cross-sector partnerships focused on making emergency savings more accessible for low-to-moderate income households. Join Claire Chamberlain, Managing Director of Social Impact at BlackRock, for a deep dive on BlackRock’s flagship philanthropic program and a closer look at their partner-centric approach to proving what is possible and advocating for what it’ll take to shift the entire system.

Bank-Fintech Partnership Powers Financial Health

Join Rochelle Gorey, CEO and Co-Founder of SpringFour, and Ben Schack, Head of U.S. Digital Partnerships for BMO Financial Group, as they discuss their innovative financial health partnership. Learn how this award-winning social impact fintech and multinational bank teamed up to solve problems and deliver assistance for customers through the pandemic and beyond. Discover the impact of their efforts on their employees and brands, and consider tips for successful fintech-bank partnerships.

Our 2021 Visionary Award: The Role of Leadership in Global FinHealth

Joined by our inaugural recipient Dan Schulman, President and CEO, PayPal, Jennifer Tescher, President and CEO, Financial Health Network, and the 2021 honoree, Her Majesty Queen Máxima of the Netherlands, United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, the discussion will include opportunities to ask questions about the role of leadership in advancing the mission and vision of financial health on a global scale.

JPMorgan Chase’s $30 Billion Racial Equity Initiative

JPMorgan Chase & Co. has committed a groundbreaking $30 billion to providing economic opportunities for underserved communities, especially Black and Latinx communities, over the next five years. This spotlight provides context for how JPMorgan Chase & Co. approaches impact at the local level, how it has integrated financial health, as a key pillar to this work, and how it is holding itself accountable to help reduce the racial wealth gap.

Why more banks are weaning themselves off overdraft fees

For several decades, U.S. banks reaped huge revenues from fees charged to customers who spent money they didn’t have, while also enduring a consumer backlash that tarnished their reputations.

Bank of America’s Essential Solutions for Financial Health

Join us for a conversation with D. Steve Boland, President of Retail and Christine Channels, Head of Community Banking and Client Protection as they discuss how they build and implement solutions like Bank of America Advantage SafeBalance™, Keep the Change®, and their Bank of America Secured Card offering, and how they are tracking and evaluating these products’ impact on customer Financial Health.

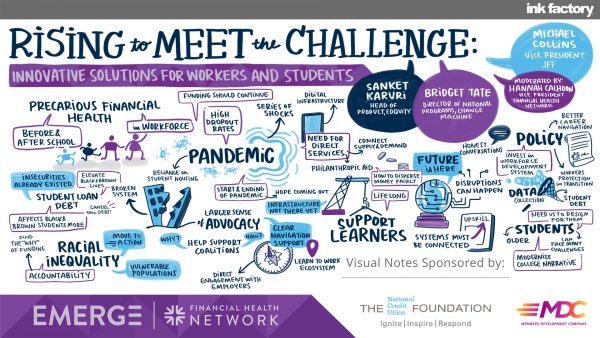

Rising to Meet The Challenge: Innovative Solutions for Workers and Students

Join us to learn how these innovators responded to the challenge, found ways to scale their offerings to meet the pressing financial health needs of the moment, and forged pathways to drive impact post-pandemic. We’ll also introduce attendees to the Financial Solutions Lab Accelerator’s new cohort of fintech startups, as we explore innovations that are helping consumers to build financial resilience and long-term stability.

Oportun Card: Advancing Economic Equity Through Financial Inclusion

Since 2005, Oportun has leveraged AI-powered models and billions of unique data points to extend more than 4 million loans and $10 billion in affordable credit. This inclusive approach has allowed nearly 1 million customers to establish their credit histories. Find out how this deep commitment to understanding customer financial needs led to a new solution for managing income volatility and covering unexpected expenses – the 2020 launch of the Oportun® Visa® credit card.