Preventing Medical Debt: Recommendations for Insurers

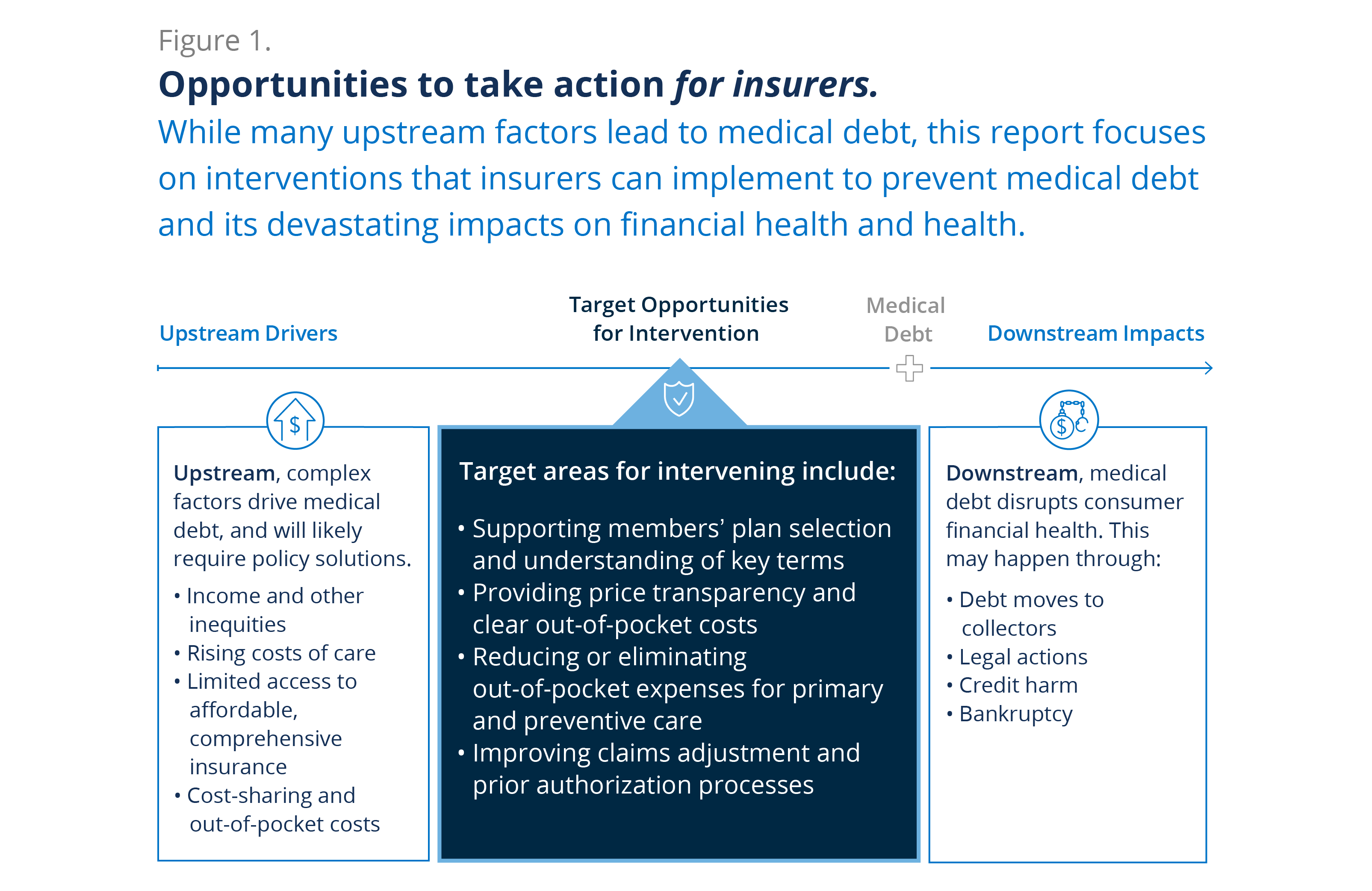

This report shows how the shifting health insurance landscape has helped shape the medical debt crisis, identifying specific actions insurers should take now to boost Americans’ confidence in their coverage and motivate them to pursue timely care that reduces the need for costlier services.

By Michelle Proser, Uzma Amin

-

Category:

Data Spotlight

91% of Americans

do not understand the meaning of premium, deductible, out-of-pocket maximum, and co-insurance.

62% of U.S. adults younger than 65

who report problems paying a medical bill say that the person who incurred the bill was insured at the time.

24% of underinsured adults

say they don’t visit a doctor when they have a medical issue.

Key Recommendations

With input from members of our Stakeholder Advisory Council, the Financial Health Network developed recommended actions and strategies for insurance providers to help prevent medical debt. Although each recommendation is effective as a stand-alone, insurers can achieve the greatest impact by implementing them all.

-

- Aid members in plan selection, and ensure members understand key health insurance terms.

- Proactively inform members of out-of-pocket expectations, and help them navigate lower-cost options through price transparency resources.

- Incentivize primary and preventive care services by reducing or eliminating associated out-of-pocket expenses.

- Improve claims adjustment and prior authorization processes.

Explore the Full Series

Systems-Level Overview

Explore insights into the prevalence of medical debt and its effect on consumers, how medical debt functions as a social determinant of health and driver of health inequities, and opportunities for key players to prevent it.

Recommendations for Hospitals and Health Systems

Read about actionable strategies healthcare providers should take now to improve financial assistance and repayment programs, support informed patient decision-making, and proactively identify patients at risk for medical debt to target financial assistance.

Recommendations for Employers

Find out about proactive steps employers should take now to assess employee health insurance affordability, educate their workforce on insurance basics and out-of-pocket costs, help workers manage healthcare expenses, and offer plans based on employees’ needs and circumstances.

Our Supporter

Support for this report series was provided by the Robert Wood Johnson Foundation. The views expressed here do not necessarily reflect the views of the Foundation.

More to Explore

Exploring the Link Between Housing and Healthcare Costs and Weather Events

Households that experienced a weather event were also more likely to face a range of unexpected housing- and health-related expenses.

Financial Strain and Health

In the United States, financial stress significantly impacts overall well-being. A staggering 40% of Americans report experiencing high stress related to money, while 76% of American households live paycheck to paycheck.

Exploring the Interconnectedness of Financial and Mental Health

Our recent Member-exclusive Executive Roundtable shared several ways organizations can support people’s financial and mental well-being.

Sign Up to Receive Our Newsletter

If you’re a healthcare professional dedicated to improving physical and financial health, sign up to receive our newsletter today.

Written by

Preventing Medical Debt: Recommendations for Insurers

Explore the trends. Discover new insights. Build stronger strategies.