Preventing Medical Debt From Disrupting Health and Financial Health: A Systems-Level Overview

This report provides an issue overview of the national medical debt crisis, describing its prevalence and effects on consumers, how medical debt functions as a social determinant of health and driver of health inequities, opportunities to prevent it, and long-term strategies for impact.

By Michelle Proser, Uzma Amin

-

Category:

Key Takeaways

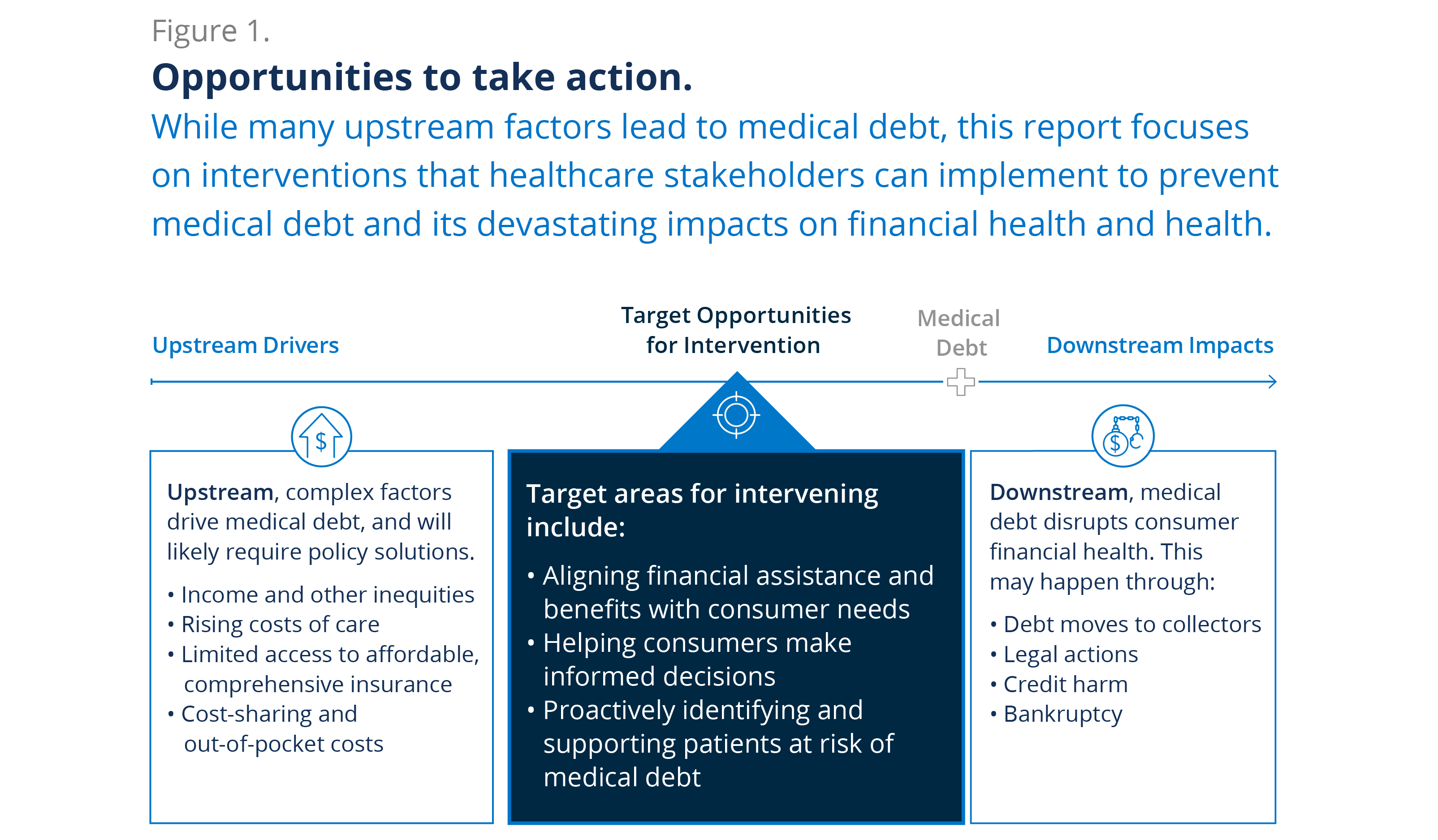

Throughout the series, we explore three key strategies for preventing medical debt.

Aligning financial assistance and benefits with consumer needs

Helping consumers make informed decisions

Proactively identifying consumers at risk of medical debt to target financial assistance and benefits

Who Can Help Prevent Medical Debt?

These recommendations are intended to inform hospitals and health systems, insurers, and employers sponsoring commercial insurance. While these stakeholders may be best positioned to drive immediate impact on medical debt, other healthcare players – including other healthcare providers and those in pharmaceuticals and government – can adapt and apply these insights for further impact.

Patient and consumer advocates can also champion these high-impact strategies for preventing medical debt, and the disruption of health and financial health that often follows.

Drivers and Impacts of Medical Debt

While many upstream factors lead to medical debt, this report series focuses on interventions that healthcare stakeholders can implement to prevent medical debt.

Explore the Full Series

Recommendations for Hospitals and Health Systems

Read about actionable strategies healthcare providers should take now to improve financial assistance and repayment programs, support informed patient decision-making, and proactively identify patients at risk for medical debt to target financial assistance.

Recommendations for Insurers

Discover opportunities insurance providers should seize now to help members navigate plan selection, understand key terminology, reduce out-of-pocket expenses, utilize preventive care, and improve administrative processes that affect customers.

Recommendations for Employers

Find out about proactive steps employers should take now to assess employee health insurance affordability, educate their workforce on insurance basics and out-of-pocket costs, help workers manage healthcare expenses, and offer plans based on employees’ needs and circumstances.

Our Supporter

Support for this report series was provided by the Robert Wood Johnson Foundation. The views expressed here do not necessarily reflect the views of the Foundation.

More to Explore

Exploring the Link Between Housing and Healthcare Costs and Weather Events

Households that experienced a weather event were also more likely to face a range of unexpected housing- and health-related expenses.

Financial Strain and Health

In the United States, financial stress significantly impacts overall well-being. A staggering 40% of Americans report experiencing high stress related to money, while 76% of American households live paycheck to paycheck.

Exploring the Interconnectedness of Financial and Mental Health

Our recent Member-exclusive Executive Roundtable shared several ways organizations can support people’s financial and mental well-being.

Sign Up to Receive Our Newsletter

If you’re a healthcare professional dedicated to improving physical and financial health, sign up to receive our newsletter today.

Written by

Preventing Medical Debt From Disrupting Health and Financial Health: A Systems-Level Overview

Explore the trends. Discover new insights. Build stronger strategies.