Pulse Points: Main Gig or Side Hustle? Nontraditional Work and Financial Health

More than 1 in 10 working adults holds a nontraditional job. How is this growing and diverse sector of the American economy faring financially?

By Wanjira Chege, Kennan Cepa, Ph.D.

-

Program:

-

Category:

-

Tags:

Understanding the Financial Realities of the Nontraditional Workforce

Comprised of approximately 19 million workers, the nontraditional workforce has expanded rapidly in the United States.1, 2 Whether freelancing, working odd jobs, or have a “side hustle,” nontraditional workers are less financially healthy than their traditionally employed counterparts – yet their financial challenges aren’t one-size-fits-all.3

For some, nontraditional work is their primary or only form of employment, while for others, it is work added on to supplement more traditional employment. Comparing primary and secondary nontraditional workers is essential for understanding the different ways nontraditional jobs may influence financial health. In this report, we use Financial Health Pulse® data to explore the range of economic realities among nontraditional workers and identify opportunities to better support their needs.

What You’ll Learn

Read the full report to dig deeper into the financial health challenges of this diverse group of workers.

Primary and secondary nontraditional workers differ by income, age, educational level, and other factors.

Primary nontraditional workers score lower in overall financial health than secondary nontraditional workers and traditional workers.

Short-term savings, credit, and insurance are the biggest financial health challenges for primary nontraditional workers.

Secondary nontraditional workers report facing long-term savings and debt management burdens.

Data Spotlight

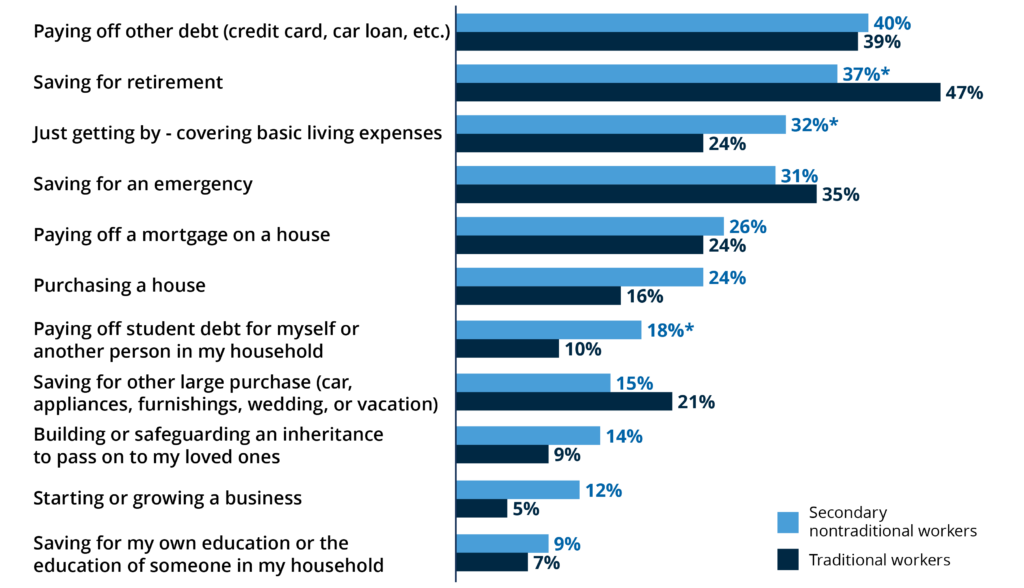

Secondary nontraditional workers were more often focused on “just getting by” than traditional workers: Percentage reporting each financial goal among their “top three” goals, by worker type.

Note: Financial Health Pulse 2024 survey data. We define nontraditional workers as those who reported at least one of their current jobs is independent contracting, “gig” work, freelancing, consulting, working odd jobs, or a “side hustle.” We categorize nontraditional workers into two groups: primary nontraditional workers, whose main job (based on most hours worked) is nontraditional work; and secondary nontraditional workers, who are traditionally employed but also take on nontraditional work. We define traditional workers as those who are working and are not engaged in any nontraditional work (including business owners). * Statistically significant relative to traditional workers at p<0.05

About Our Methodology

Data for this report comes from the 2024 Financial Health Pulse survey fielded from April 16, 2024, through May 30, 2024. The survey contained 7,245 respondents and a participant cooperation rate of 65.67% (margin of error +/- 1.15%). Now in its seventh year, Financial Health Pulse fields its surveys using the probability-based Understanding America Study online panel administered by USC’s Dornsife Center for Economic and Social Research, allowing the findings to be generalized to the civilian, noninstitutionalized adult population of the United States. For more information and background on our financial health measurement methodology, see the FinHealth Score® Methodology page.

About the Financial Health Pulse® and Pulse Points

Since 2018, the Financial Health Network has conducted the Financial Health Pulse® research initiative. The Financial Health Pulse combines probability-based, longitudinal survey data with administrative data, with the goal of providing regular updates and actionable insights about the financial lives of Americans.

Pulse Points are short research reports released multiple times a year as part of the Financial Health Pulse research initiative. Pulse Points are designed to explore specific, timely topics related to financial health. To see more of our Financial Health Pulse research, including Pulse Points on student loans, natural disasters, and more, please visit our Pulse Research page.

- Jonathan Gruber, “How should we provide benefits to gig workers?,” Brookings Institution, June 2024.

- “Authentic and Intentional: State of Independence in America 2024,” MBO Partners, 2024.

- Lawrence F. Katz & Alan B. Krueger, “The Rise and Nature of Alternative Work Arrangements in the United States,” National Bureau of Economic Research, September 2016.

Written by

Pulse Points: Main Gig or Side Hustle? Nontraditional Work and Financial Health

Explore the trends. Discover new insights. Build stronger strategies.